Endowing Iowa

Feb 23, 2011

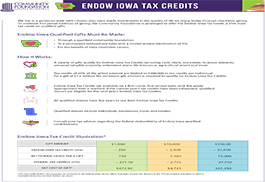

The Endow Iowa Tax Credit Program generated nearly $13 million in donations to 71 of Iowa's community foundations in 2010, according to the Iowa Council of Foundations. The 25 percent tax credit is open to any Iowa taxpayer (individuals as well as businesses) for gifts made to permanently endowed funds at qualified community foundations, explains Angela Dethlefs-Trettin, the Council's executive director.

"The power of the tax credit is that it's an accessible way that every member of the community can give back," says Dethlefs-Trettin. "You don't have to be a millionaire to use the credit; it engages everyone into thinking long term for their community."

She notes that about 1,200 of the 1,723 gifts that utilized the credit last year were for $1,000 or less.

Determine how much you can save in taxes, and how much your donation will grow, through the program.

Interview with Angela Dethlefs-Trettin about the Endow Iowa Tax Credit program.