Adding Flexibility to Charitable Trusts Through Donor Advised Funds

Apr 22, 2015

Adding Flexibility to Charitable Trusts through Donor Advised Funds

Charitable trusts are an effective tool for facilitating philanthropy, but when used in partnership with a donor advised fund their flexibility as a giving resource becomes even more appealing.

A donor advised fund (DAF) is a charitable giving vehicle, administered by a public charity, created to manage charitable donations on behalf of families or individuals. DAFs work like a charitable checking or savings account allowing donors to grow their charitable assets over time while supporting the causes they care about.

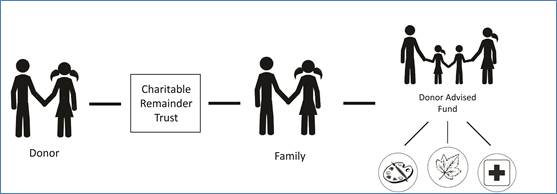

Individuals who use a DAF in combination with a charitable remainder trust (CRT) name their DAF (held at the Community Foundation) as the remainderman. This becomes a strategic planning tool offering the opportunity for a lifetime, and family giving for years to come. Here’s how it works:

- A donor contributes to a CRT and receives charitable tax benefits.

- The trust income beneficiary (typically the donor & spouse) receive a lifetime income stream from the CRT.

- At the termination of the trust, the remainder interest is transferred to the DAF.

- The donor’s family stays involved in creating a legacy of giving by advising the distributions from the DAF to causes they care about.

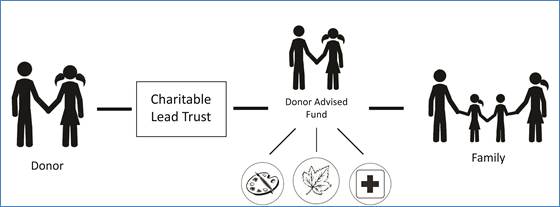

DAFs offer many opportunities for individuals and families to create a legacy of giving without the pressure associated with the selection of ultimate charities. DAFs may be used for charitable giving during a donor’s lifetime with the DAF becoming the charitable overflow from the CRT if and when the income from the CRT is no longer needed.DAFs can also be an effective tool to use in combination with charitable lead trusts (CLT). In this scenario:

- A donor contributes assets to the CLT for a specific time period (term of years or life) and receives tax benefits for the gifts.

- The annual distribution from the CLT is made into the DAF, which is then advised by the family to causes they care about.

- After a specific period, the remainder interest from the CLT goes to the family (or other designated beneficiaries).

By coupling charitable trusts and DAF’s, greater flexibility and increased family engagement in the joy of giving is possible. The DAF enhances the trust and provides donors with an opportunity to engage in planned giving on terms that are ideal for them.

At the Community Foundation of Greater Des Moines, we are proud to serve as a charitable resource for you and your clients. Together we can explore customized opportunities, such as these, to meet the financial and giving goals of those you serve. Contact Sheila Kinman, chief advancement officer, at kinman@desmoinesfoundation.org or 515-447-4207 to discuss how we can assist you.